Which Age Team Pays the Most for Cars and truck Insurance policy? Since 1984, The Hartford has helped nearly 40 million AARP members get the automobile protection they need with unique benefits as well as discounts What State Has the Cheapest typical car insurance policy prices? According to III, in 2017, these states had some of the lowest auto insurance policy prices:8 To learn much more, obtain a quote from us today.

They'll assist you get the auto policies you require, whether it's to aid pay for damages after an accident or to protect you from collisions with uninsured motorists - car insurance.

Your very own expenses might differ. The quickest method to discover out exactly how a lot a cars and truck insurance plan would cost you is to make use of a quote calculator tool.

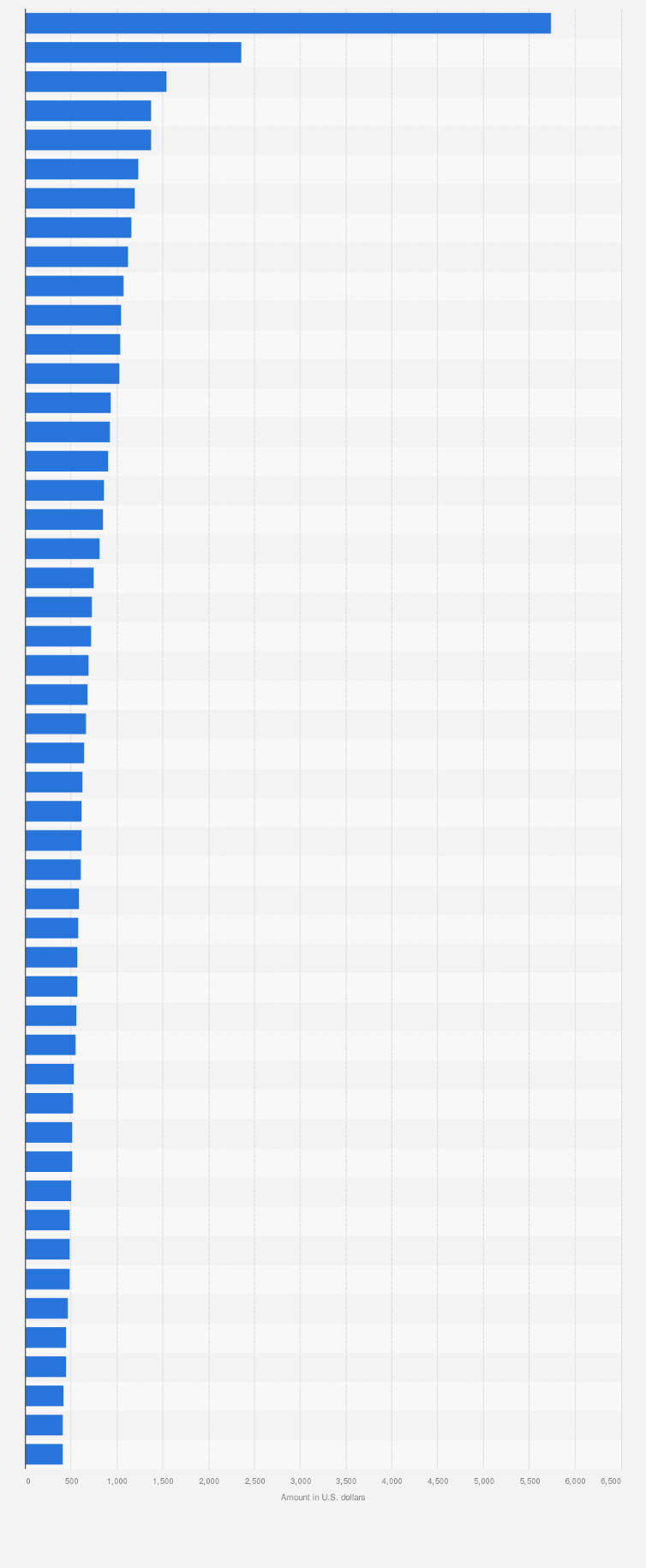

Various states additionally have various driving problems, which can affect the expense of vehicle insurance. To provide you some suggestion of what motorists in each state spend each year on car insurance, the table listed below shows the average expense of car insurance by state, according to the 2021 NAIC Vehicle Insurance Coverage Database Record (accident).

What Is The Average Cost Of Car Insurance In California? Can Be Fun For Everyone

Packing: Packing your house and also vehicle insurance policy policies typically results in premium discounts - cheapest. If you are able to pay your entire premium at when, it's commonly a more cost-efficient option.

Our technique Due to the fact that customers count on us to supply objective and also accurate information, we produced a comprehensive score system to create our rankings of the very best cars and truck insurance business. We gathered data on dozens of auto insurance carriers to grade the firms on a vast array of ranking elements. The end result was an overall rating for each and every company, with the insurers that racked up one of the most factors topping the listing.

Availability: Vehicle insurance policy companies with better state availability as well as few qualification demands racked up highest possible in this category. insured car. One of the largest elements for customers looking to acquire auto insurance is the price. Not only do prices vary from company to firm, but insurance policy expenses from state to state vary.

Not known Factual Statements About Average Car Insurance Rates By Age And State (May 2022)

affordable car insurance cheaper cars prices vehicle insurance

affordable car insurance cheaper cars prices vehicle insurance

Average prices differ widely from one state to another. Insurance policy rates are based on multiple standards, consisting of age, driving background, debt score, how several miles you drive each year, car type, and also extra. Depending on typical vehicle insurance coverage sets you back to approximate your cars and truck insurance coverage costs might not be the most accurate way to identify what you'll pay.

, and you may pay more or less than the average vehicle driver for insurance coverage based on your threat profile. risks. Younger vehicle drivers are generally extra likely to get right into a mishap, so their premiums are generally greater than average.

It may not give sufficient security if you're in an accident or your lorry is damaged by one more covered event. Interested about just how the average cost for minimum protection piles up versus the price of full protection?

Yet the only means to know precisely how much you'll pay is to search as well as get quotes from insurance companies. One of the factors insurance companies use to identify prices is place. Individuals that reside in locations with higher burglary rates, accidents, as well as all-natural disasters normally pay even more for insurance. And also because insurance coverage laws and also minimal protection needs vary from state to state, states with higher minimum needs commonly have greater average insurance costs.

The Average Car Insurance Rates By Age And State (May 2022) Ideas

Many however not all states allow insurer to make use of credit rating when establishing rates. In general, candidates with lower scores are extra likely to file an insurance claim, so they generally pay extra for insurance coverage than drivers with higher credit report ratings. If your driving document consists of crashes, speeding up tickets, DUIs, or various other infractions, expect to pay a higher costs.

Since insurance business have a tendency to pay more claims in risky areas, rates are normally greater. cars. Getting ample insurance coverage may not be low-cost, but there are methods to obtain a discount on your auto insurance policy.

If you own your home rather of Click for info renting it, some insurance providers will certainly give you a discount rate on your auto insurance premium, also if your home is insured via an additional company. Other than New Hampshire and Virginia, every state in the country needs vehicle drivers to keep a minimum amount of obligation coverage to drive legitimately.

It may be alluring to stick to the minimum limitations your state needs to minimize your premium, but you could be placing on your own at danger. State minimums are notoriously reduced and also could leave you without adequate defense if you're in a serious mishap. A lot of professionals advise preserving sufficient coverage to secure your properties.

How Much Is Car Insurance? - The Balance Fundamentals Explained

To help you recognize exactly how rates vary, Cash, Nerd broke down The golden state's typical price according to the elements most affecting it. cars. Ordinary Cost of Auto Insurance Coverage in The Golden State: Recap, There are many elements impacting auto insurance policy prices in The golden state. Age is the aspect that affects premium rates the most, adhered to by exactly how much coverage you acquire.

Its roadways are additionally a few of the busiest The golden state has the third-highest website traffic density in the country making collisions extra most likely to take place.17% of California chauffeurs are without insurance, placing the state in 10th area - cars. Electric motor theft is additionally typical. Both add to the high likelihood of drivers filing cases. Average Expense of Cars And Truck Insurance in The Golden State: Full Coverage vs.

Just how much Is Auto Insurance Coverage in California by Age, Automobile insurance policy prices in California for young motorists are normally very high due to the fact that service providers consider them riskier to guarantee. It's the same situation for first-time chauffeurs. A 16-year-old would be far better off being contributed to their moms and dads' auto insurance policy than purchasing one on their own.

California is just one of those states, together with Hawaii and also Massachusetts. Therefore, your credit report score has no influence on your insurance coverage prices in this state. Exactly How Much Is Vehicle Insurance Coverage in Your City? The expense of vehicle insurance differs from one state to another. It also varies in between cities within the exact same state (cheapest car insurance).

5 Easy Facts About What Is The Average Cost Of Car Insurance? - Moneyhelper Described

4% reduced than the typical expense of car insurance in California. 8% higher than the state standard as well as even more than dual Santa Maria's rate.

Here are the ones frequently asked the answers might assist you comprehend how much car insurance costs in California - insured car. Broaden ALLWhat is the average expense of auto insurance in The golden state?

It is for a 40-year-old vehicle driver with a tidy driving document. We also made use of data from the following resources to complete the analysis:2019 information from the Federal Highway Administration to calculate freeway traffic density2019 data from the Insurance coverage Research study Council to establish information on uninsured drivers, The most recent information from the united state

cheaper car insurance credit score cheapest car car insured

cheaper car insurance credit score cheapest car car insured

vehicle insurance affordable car cheaper car

vehicle insurance affordable car cheaper car

Due to the fact that insurance policy firms have a tendency to pay even more claims in high-risk locations, prices are normally higher. Getting ample protection might not be cheap, however there are ways to get a discount on your auto insurance coverage.

How How Much Is Car Insurance Per Month? Average Cost can Save You Time, Stress, and Money.

If you have your home rather than leasing it, some insurance providers will certainly offer you a price cut on your automobile insurance policy premium, also if your residence is insured via one more company. Aside From New Hampshire and Virginia, every state in the nation requires vehicle drivers to keep a minimum amount of responsibility insurance coverage to drive legitimately.

It might be tempting to stick to the minimal limits your state needs to minimize your costs, however you could be putting yourself in danger. State minimums are infamously reduced and also could leave you without adequate defense if you're in a significant crash. A lot of specialists advise maintaining sufficient insurance coverage to secure your possessions.

To aid you understand how prices vary, Money, Nerd broke down The golden state's average price according to the variables most influencing it. Typical Cost of Auto Insurance Policy in California: Recap, There are numerous aspects influencing cars and truck insurance coverage rates in The golden state. Age is the element that impacts costs costs one of the most, adhered to by just how much coverage you acquire.

vehicle insurance vans insurance affordable prices

vehicle insurance vans insurance affordable prices

, putting the state in 10th area. Both add to the high possibility of motorists submitting cases (insured car). A 16-year-old would be better off being added to their moms and dads' car insurance policy than buying one on their very own.

How Much Is Automobile Insurance in Your City? The price of automobile insurance policy differs from state to state.

4% reduced than the average price of auto insurance in The golden state. 8% higher than the state standard and also more than double Santa Maria's price.

Here are the ones frequently asked the solutions might assist you understand exactly how much auto insurance policy prices in The golden state. EXPAND ALLWhat is the ordinary price of vehicle insurance policy in California? The typical cost of cars and truck insurance policy in California is $1,429 per year or $119 monthly. It places 38th amongst states, with # 1 being the most affordable (cheap insurance).

How Much Does Car Insurance Cost In May 2022? - Newsxpro for Beginners

It is for a 40-year-old driver with a clean driving document (dui). We also made use of information from the adhering to resources to finish the analysis:2019 data from the Federal Highway Administration to compute freeway traffic density2019 information from the Insurance coverage Research Council to establish information on uninsured motorists, The most recent information from the united state